Car owners often purchase insurance but frequently switch providers once their policies expire in search of better deals. For drivers — particularly pickup truck owners — having reliable coverage is essential. Discover why quality insurance matters for pickup truck drivers in this article: https://pickuptrucktalk.com/2025/05/why-every-pickup-truck-driver-in-qatar-needs-quality-car-insurance/.

To retain customers in such a competitive market, insurance companies must go beyond offering low prices. Building customer loyalty requires delivering consistent value and meaningful experiences at every touchpoint. Industry leaders understand this and have perfected the art of forging strong connections that stand the test of time.

In this guide, we’ll explore seven strategic steps to help you cultivate loyalty and build lasting relationships, even in the face of fierce competition.

Step 1: Offer transparent pricing

Transparency is the foundation of trust. Customers want honesty, especially when it comes to pricing. Hidden fees and unexpected premium hikes erode relationships, while clear communication sets you apart.

Here’s how to ensure transparency:

- Break down how premiums are calculated. Use interactive tools to show customers how coverage adjustments influence their rates in real time.

- Reward loyalty, not just new customers. Proactively notify long-term clients when they qualify for better rates, demonstrating you value their commitment.

- Tailor pricing strategies by product type. Recognize that price sensitivity varies. Auto insurance is heavily price-driven, while life insurance customers often prioritize stability over savings.

Step 2: Deliver exceptional products and service

Once pricing is clear, focus on delivering an outstanding experience.

- Offer flexible coverage. Develop modular products that adjust as customers’ needs evolve, positioning your company as a lifelong partner rather than a static policy provider.

- Simplify policy language. Use plain language and visual aids to explain coverage. Clear, straightforward communication significantly boosts satisfaction.

- Turn claims into loyalty opportunities. A seamless, supportive claims process can transform a stressful interaction into a trust-building moment. Quick responses, clear timelines, and consistent updates are key.

Step 3: Build consistent trust

Trust isn’t built through occasional excellence — it’s earned through consistent reliability.

- Be a trusted advisor. Provide valuable, educational content that helps customers make informed decisions beyond simply paying premiums.

- Be honest, even when it’s difficult. Clearly explain coverage limitations to avoid misunderstandings during claims. Transparency prevents disappointment and fosters trust.

- Deliver on your promises during claims. Guarantee response times and train adjusters to handle claims with empathy and care.

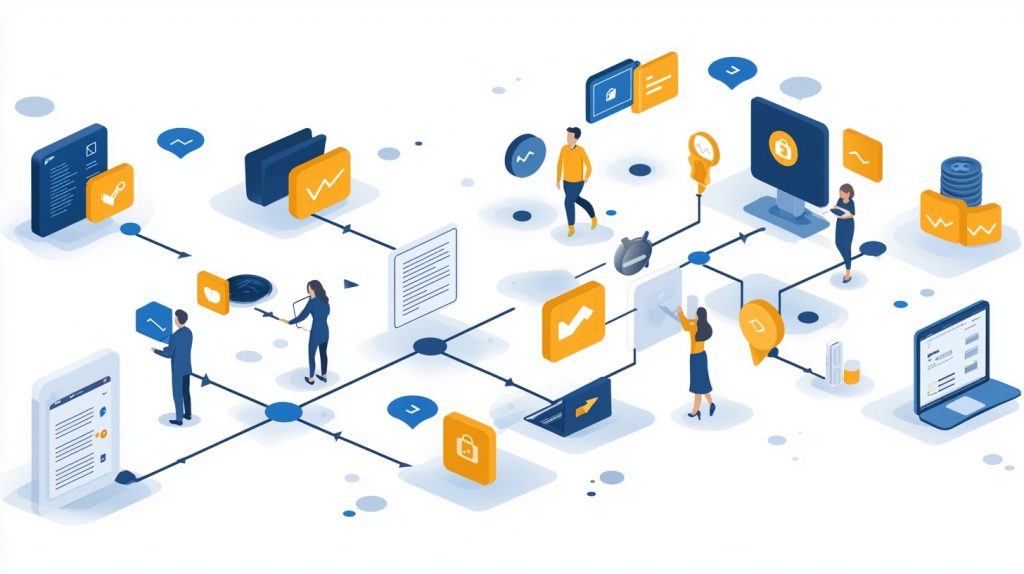

Step 4: Enhance accessibility and communication

Make it easy for customers to reach you.

- Offer multi-channel support. Combine phone service, chat, mobile apps, and extended hours. Let customers choose how they want to communicate.

- Simplify communication. Avoid jargon and test your messaging with real customers. If they can’t explain it back, revise it.

- Proactively update customers. Use automated updates during claims processes to reduce anxiety and unnecessary follow-ups.

Step 5: Create personalized experiences

Generic service is no longer enough. Personalization is a must.

- Focus on life events. Anticipate customer needs during key milestones like buying a home or having a baby, and offer relevant coverage.

- Respect preferences. Let customers control how often and through which channels they receive communication to avoid overwhelming them.

- Use data insights. Tailor recommendations based on past interactions, claims, and behavior to make offerings more relevant.

Step 6: Develop a loyalty and rewards program

A good loyalty program boosts customer retention by providing extra value.

- Partner with other businesses. Work with retailers, travel companies, or service providers to create added perks, like discounts on repairs or security systems.

- Offer financial rewards. Use claims-free cashback, renewal rebates, or bonuses to reward loyalty and improve satisfaction.

- Provide lifestyle benefits. Keep customers engaged with wellness programs, safe driving apps, or discounts for smart home device use or gym attendance.

Step 7: Empower customers with control and recognition

Giving customers control and appreciation builds loyalty.

- Enable customization. Let customers adjust coverage and rewards to fit their needs, making policies feel personal.

- Recognize loyalty. Celebrate anniversaries, offer priority service, and create a community with exclusive events or forums for long-term customers.

- Invest in tech. Use tools like telematics or wearables for personalized pricing and rewards, benefiting both you and the customer.